I have this one friend—lets call him Trevor. Trevor has a part-time job, just as many full-time college students do. And also like many college students, he has grants and a small scholarship here and there, but mostly loans.

What’s interesting about Trevor is that despite his financial standing, he has the newest iPhone and Xbox games, and goes out to eat almost every day. On the surface, there’s nothing wrong with this, but considering the fact that he’s more than $60,000 in debt, has no savings account (or rather, nothing in it), and complains about paying rent each month, I’d say his lifestyle is a bit over-the-top.

I’m sorry if I don’t sound sympathetic, but Trevor is not alone in his way of living, especially among millennials. The more I hear people talking about spring break trips to Cabo and VIP tickets to the Jay-Z concert, the less I hear about saving for the future. According to a survey done last year by the Employee Benefit Research Institute, millennials are actually less likely to save for retirement than employees 10 years ago were.

But lets take a step back. Say you’re living the “Trevor lifestyle” your senior year, waiting to get that much-needed post-graduation job—but it never comes. By then, you have to start paying for your loans, rent (assuming you aren’t living with your parents), and all the other expenses that come with being a grown-up. Having just a small cushion for when things don’t go as planned can go a long way.

The good news is that, because of the economic crisis, it’s not our fault that saving money is harder than it used to be. A study by the Pew Research Center has found that young adults acquire much more debt than older adults did during and after the Great Recession. The economy has gotten significantly better in the last few years, but we are still not in a position to ignore our responsibilities, both present and future.

We also have to look very closely at debt: how to avoid it and how to get rid of it when we do accumulate it. Avoiding it is difficult. College is expensive, and not many people can afford to enroll in classes without a loan or two. Last year, one in five households in the U.S. owed money for college loans. But if there’s one thing I’ve learned from dealing with finances as a college student, it’s that federal loans, the loans we are offered through AidLink, are much easier to manage than private bank loans. While federal loans can be excused in certain circumstances, private loans—and the heavy interest that comes with them—will definitely stick with you.

Of course, the ideal situation would be to not have loans at all. And for this, I have one word: scholarships. There’s an old rumor that says each year millions of scholarships go unclaimed, mainly because people simply don’t know about them. The interesting thing about scholarships is that you don’t necessarily need to have a 4.0 GPA to get one. They’re available to students for things such as race, disability, organization membership, religion, hometown and countless others. All it takes is a Google search to find one that could potentially be the right fit for you. If I have one regret in my entire college experience, it would be that I didn’t take advantage of those opportunities earlier on. Needless to say, it would have saved me a whole lot of grief, not to mention quite a few bucks.

So whether you’re like my friend Trevor and spend money now without thinking of the future, or you’re a person that does a little saving here and there, college students always have to be extra aware of money. It’s something we as a generation need to work on if we plan on maturing into financially stable adults.

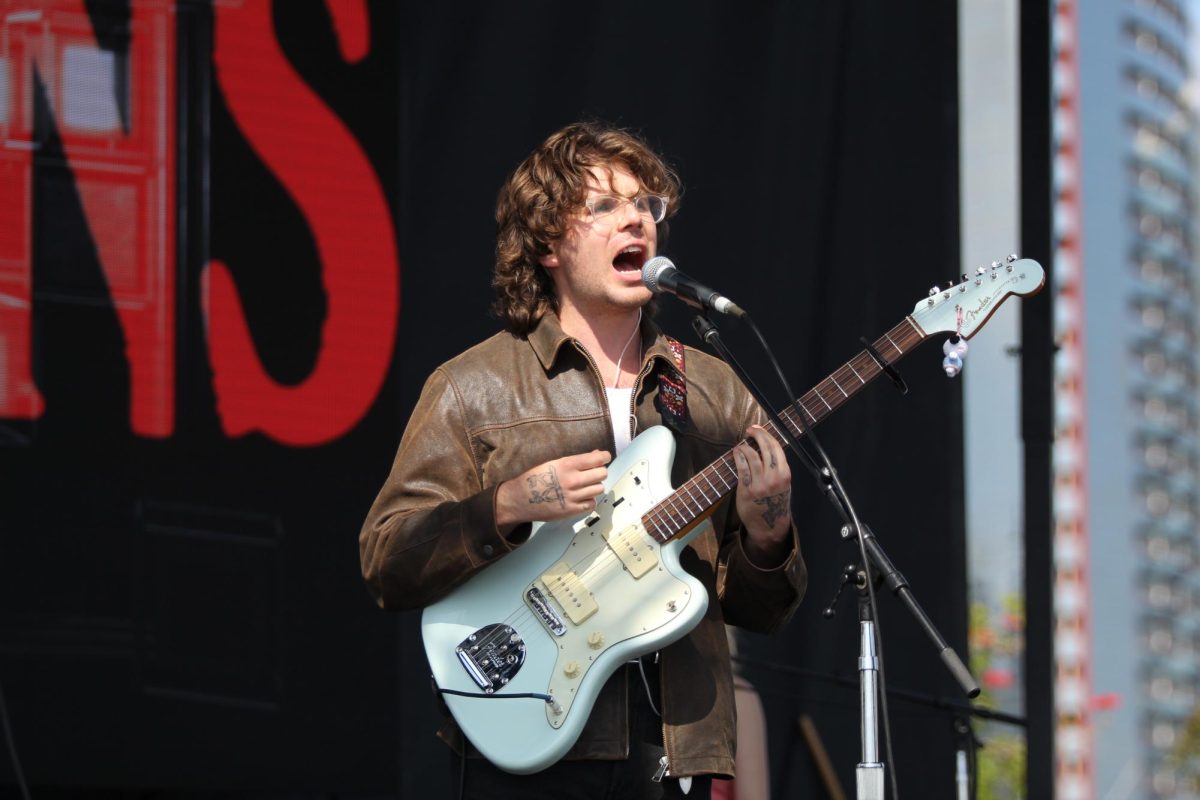

Photo courtesy of MCT Campus