Late-night cramming sessions, overdoses on caffeinated drinks and sleep-deprived exam mornings: Students think the worst is done once they put on their caps and gowns. But outside the college world, students will face a new set of challenges. These challenges include moving from being financially dependent to finding one’s own financial independence.

However, the real challenge recent college graduates face is having the needed information and resources to guide them in the right financial direction.

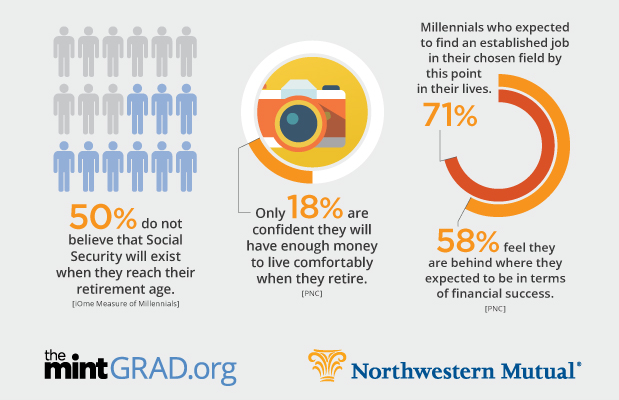

Northwestern Mutual is a life insurance company that recently created a website aimed at millennial college graduates, TheMintGrad.org. TheMintGrad.org is an online resource generated to empower students and recent graduates to carve a path toward financial independence. The website is filled with interactive activities, such as quizzes and personalized steps, informative videos and expert advice to help students find financial success.

“We’re committed to guiding millennials to be money smart and financially fit,” according to the TheMintGrad.org website.

Although millennials have proven they can overcome financial challenges in the past, there are still obstacles graduates should be aware of. TheMintGrad.org offers solutions to these unique financial difficulties and encourages students to set financial goals to plan for a successful financial future.

Manager of TheMintGrad.org Jean Towell reinforces the idea that the website encourages students to think beyond financial goals. Towell said young adults need financial guidance, and everyone in general could use additional information, knowledge and understanding to achieve better financial goals.

The tools and quizzes the website offers help students customize their own paths toward financial success. The strategy is that if students assemble their own financial future, they will push themselves to fulfill their financial goals.

“We don’t want to lecture you or dictate what you do,” Towell said. “This is something you own and drive yourself.”

The website is millennial-friendly and unique with interactive tools.

“The tools are fun and engaging, not intimidating, so that you can customize what you need,” Towell said. “Most sites expect you to commit to a product or service, and or, require you to purchase something.”

Towell is leading a movement for the millennial generation: Financial Loving Care. The idea is to encourage students to set goals for themselves and make smart money decisions to prepare for a financially secure future. The goal is to give your wallet some financial loving care, a constant theme throughout the website.

“The FLC is more than a message,” Towell said. “It’s a call to action. It’s about accepting, reflecting and committing to your own personal financial goals.”

Chantel Bonneau is a contributor to TheMintGrad.org and suggests college students strive for financial independence, beginning immediately. Although financial goals are different for a freshman in college than those taking on fourth or fifth years, it’s never too early to start financial planning.

“As millenials graduate college and enter the workforce, this world has new financial challenges,” Bonneau said. “The key is planning and setting capable lifelong goals.”

San Diego State College of Business Administration Director of Graduate Programs, Nikhil Varaiya, is also a professor in the finance department and believes students will not harm themselves from using the website. Along with using the website, Varaiya encourages students to take advantage of the resources SDSU offers as well, such as a personal finance class.

“The website can be useful, but not by itself,” Varaiya said.

Varaiya urges students to take the financial course and become familiar with the language before looking for additional help regarding financial planning. However, he believes students should begin thinking about their financial futures well before graduation.

Bonneau is also a college unit director for Northwestern Mutual and wanted to leave students with four useful tips to better achieve financial success:

1. Take control of your budget and balance sheets

This is the most important financial decision a student can make. Once a student understands their personal cash flow (money coming in, such as an income and money that will be used on a monthly basis) they can begin controlling and minimizing unnecessary spending.

2. When it comes to student loan debts, don’t delay other important financial decisions

Although student loans debts should be a priority, Bonneau warns students to not let them paralyze you. Continue to pay these loans back, but once you begin to take control of your budget, you should also be making retirement contributions, growing an emergency fund and protecting your income in case of a disability.

3. Build an emergency fund

An emergency fund is also considered a “rainy day fund,” and is usually large enough to pay for three to six months of expenses. This money is not necessarily needed right away, but is ready in case something out of your control comes your way.

4. Be informed

You should always know what your student loans are, monthly bills and how much you are making each month. Bonneau put it simply, know your budget, referring back to tip No. 1.

“All good things in life start with a plan,” Towell said. “The sooner you get started, the better.”

Infograph courtesy of TheMintGrad.org.